Little Known Questions About Transaction Advisory Services.

Wiki Article

Examine This Report on Transaction Advisory Services

Table of ContentsOur Transaction Advisory Services PDFsTransaction Advisory Services for DummiesSome Of Transaction Advisory ServicesTransaction Advisory Services Things To Know Before You Get ThisSome Ideas on Transaction Advisory Services You Need To Know

This step makes sure the company looks its ideal to possible buyers. Obtaining the business's value right is critical for an effective sale.Transaction experts action in to help by getting all the needed information organized, addressing inquiries from purchasers, and arranging brows through to the service's location. This constructs count on with customers and keeps the sale moving along. Getting the best terms is vital. Purchase advisors utilize their proficiency to aid business owners handle hard arrangements, satisfy purchaser assumptions, and framework offers that match the proprietor's goals.

Satisfying legal regulations is vital in any type of organization sale. They assist service proprietors in preparing for their following steps, whether it's retired life, starting a brand-new endeavor, or handling their newly found wide range.

Transaction consultants bring a wide range of experience and expertise, making certain that every element of the sale is managed skillfully. Via tactical prep work, valuation, and settlement, TAS assists organization proprietors achieve the highest possible list price. By guaranteeing legal and regulatory compliance and managing due diligence together with other deal staff member, transaction consultants lessen possible threats and responsibilities.

How Transaction Advisory Services can Save You Time, Stress, and Money.

By contrast, Huge 4 TS groups: Work on (e.g., when a potential customer is carrying out due persistance, or when a deal is closing and the buyer needs to incorporate the company and re-value the vendor's Balance Sheet). Are with charges that are not connected to the bargain closing efficiently. Earn fees per involvement somewhere in the, which is much less than what financial investment financial institutions make also on "tiny deals" (yet the collection likelihood is additionally much higher).

The interview questions are really similar to financial investment financial interview questions, but they'll concentrate more on accounting and appraisal and much less on subjects like LBO modeling. Expect questions concerning what the Modification in Working Funding ways, EBIT vs. EBITDA vs. Net Revenue, and "accounting professional only" subjects like trial balances and how to stroll with occasions using debits and credit ratings as opposed to monetary declaration modifications.

What Does Transaction Advisory Services Do?

Professionals in the TS/ FDD teams might also interview management about everything over, and they'll write an in-depth report with their findings at the end of the procedure., and the basic shape looks like this: The entry-level duty, where you do a whole lot of data and financial evaluation (2 years for a promo from below). The following level up; similar work, but you get the more fascinating bits (3 years for a promotion).

Specifically, it's hard to get advertised past the Supervisor degree since few individuals leave the job at that stage, and you require to begin more tips here revealing evidence of your capacity to produce revenue to advance. Allow's begin with the hours and way of life since those are less complicated to define:. There are occasional late evenings and weekend job, but nothing like the agitated nature of investment banking.

There are cost-of-living adjustments, so expect reduced settlement if you're in a more affordable area outside major financial (Transaction Advisory Services). For all placements except Partner, the base pay makes up the mass of the complete settlement; the year-end bonus offer could be a max of 30% of your base pay. Often, the most effective means to boost your incomes is to switch to a different company and discuss for a greater income and incentive

See This Report on Transaction Advisory Services

You can enter into corporate growth, but investment banking obtains harder at this phase since you'll be over-qualified for Analyst functions. Company financing is still an alternative. At this stage, you need to just remain and make a run for a Partner-level function. If you want to leave, maybe relocate to a customer and execute their assessments and due persistance in-house.The primary issue is that due to the fact that: You usually require to join an additional Big this contact form 4 group, such as audit, and work there for a couple of years and after that relocate right into TS, work there for a few years and after that move into IB. And there's still no assurance of winning this IB function since it depends upon your region, clients, and the working with market at the time.

Longer-term, there is additionally some danger of and due to the fact that reviewing a company's historical economic details is not exactly rocket scientific research. Yes, human beings will always require to be included, yet with more innovative technology, lower headcounts might possibly sustain client involvements. That stated, the Purchase Providers team beats audit in terms of pay, job, and departure chances.

If you liked this short article, you could be thinking about analysis.

Transaction Advisory Services Fundamentals Explained

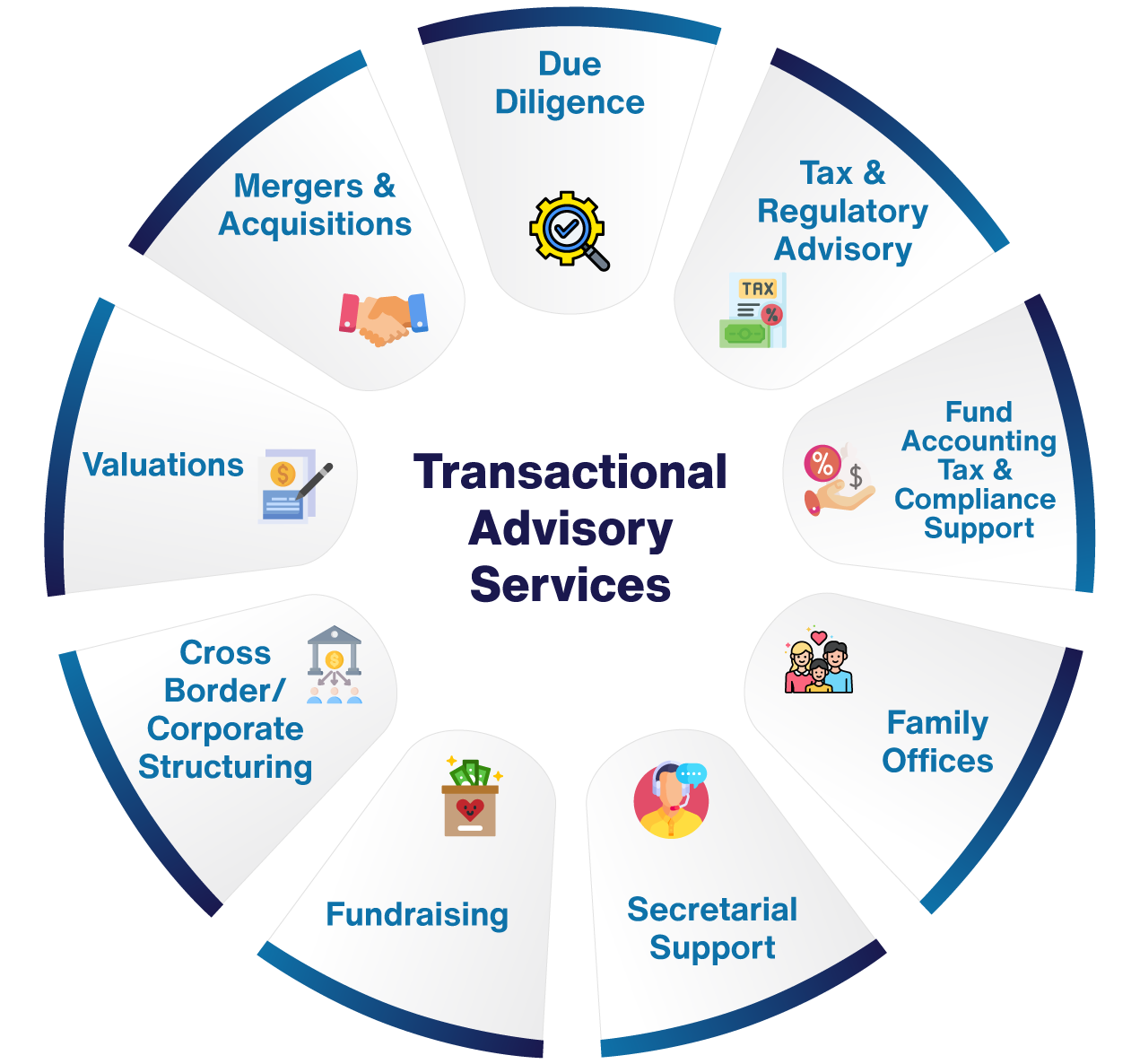

Develop innovative financial frameworks that aid in establishing the real market worth of a firm. Supply advisory job in connection to company evaluation to aid in negotiating and pricing frameworks. Clarify one of the most appropriate kind of the deal and the sort of consideration to employ (money, supply, gain out, and others).

Carry out integration planning to additional reading establish the process, system, and business changes that may be required after the deal. Set guidelines for integrating departments, technologies, and organization procedures.

Examine the prospective client base, industry verticals, and sales cycle. The operational due diligence provides important insights right into the functioning of the firm to be gotten worrying danger assessment and worth creation.

Report this wiki page